Umbrella and Cyber Take Center Stage as Premiums Continue to Rise

Written by: Staff Writer | July 2, 2021

Jump to section

An overview of The Council of Insurance Agents & Brokers’ Commercial Property/Casualty Market Index Q1/2021.

Across the U.S. and the world, businesses are opening up and people are getting back to work. As of this writing, those fully vaccinated in the U.S. stands at nearly 50%. There are hopeful signs that the pandemic’s impact on market conditions is letting up, but despite the good news, premiums continued to rise in the first quarter of 2021. Although double-digit increases continue, the severity of the march upward for all accounts slowed for a second quarter.

Each quarter, The Council of Insurance Agents & Brokers releases its Commercial Property/Casualty Market Report. Here, we review the 1Q 2021 findings.

Market hardening continued with the average commercial premium increase slightly lower in the first quarter at 10% across all account sizes, compared to 10.7% in 4Q 2020 and 11.7% in 3Q 2020. This was the 14th consecutive quarter premiums have increased.

When segmenting accounts by size, large accounts saw the biggest increases at 12.9%. Medium accounts followed at 10.9%, and small accounts at 6.3%.

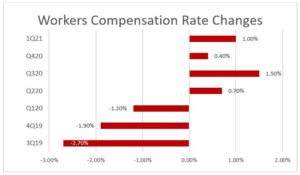

This was the fourth consecutive quarter to see premium increases for all lines, even for workers compensation, which historically has been a safe haven in insurance.

LINES MOST AFFECTED

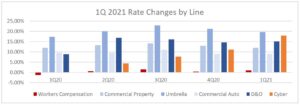

Umbrella and cyber were the most troubled lines in the first quarter. Umbrella saw an increase of 19.7%, the highest average premium increase among commercial lines. Given news reports over the last year and half, it is no surprise that cyber saw the second-highest rate increase at 18%, compared to 11.1% in 4Q 2020 and 7.7% in 3Q 2020. This represents a big jump for a line, which typically sees 1% to 2% increases.

Umbrella and cyber were the most troubled lines in the first quarter. Umbrella saw an increase of 19.7%, the highest average premium increase among commercial lines. Given news reports over the last year and half, it is no surprise that cyber saw the second-highest rate increase at 18%, compared to 11.1% in 4Q 2020 and 7.7% in 3Q 2020. This represents a big jump for a line, which typically sees 1% to 2% increases.

Given that countless businesses suddenly were thrust into a remote work model in 2020, it would be logical that the time period presented the best opportunity for cyberthreats. However, the number of companies hit by ransomware saw a 102% overall increase in the first half of 2021 compared to 2020, according to cybersecurity firm Check Point Research. The company stated that it has seen an average of over 1,000 organizations impacted by ransomware each week.

Ransomware remains the top concern as demands for payouts increase and hackers exploit the remote workforce. Additionally, General Data Protection Regulation (GDPR) fines increased by 40% in the past year, according to a report from DLA Piper, and that trend is expected to accelerate this year.

In addition to umbrella and cyber increases, D&O, commercial property, and employment practices liability saw double-digit increases at 15.1%, 12%, and 10.8% respectively.

“Carriers continued to push for rate increases in umbrella noting factors such as nuclear verdicts or social inflation and began to pull back on cyber risk in the face of rapidly increasing claims from ransomware and attacks that exploit the remote workforce,” according to Ken A. Crerar, president and CEO of The Council. While COVID-19 infection rates have been decreasing steadily and employers are bringing their employees back to the office, Crerar says we’ll need to “brace for aftershocks as we return to a new normal.”

“Carriers continued to push for rate increases in umbrella noting factors such as nuclear verdicts or social inflation and began to pull back on cyber risk in the face of rapidly increasing claims from ransomware and attacks that exploit the remote workforce,” according to Ken A. Crerar, president and CEO of The Council. While COVID-19 infection rates have been decreasing steadily and employers are bringing their employees back to the office, Crerar says we’ll need to “brace for aftershocks as we return to a new normal.”

UNDERWRITING CAPACITY & FLEXIBILITY

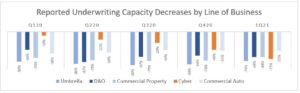

Where significant premium changes exist, decreased capacity continued to follow, such as for umbrella, D&O, commercial property, and commercial auto. Cyber experienced a 73% decrease in capacity as insurers were increasingly cautious compared to the previous four quarters.

There was an 79% reduction in umbrella capacity in this quarter, which was better than the previous four quarters. Capacity is shrinking for umbrella and excess, and pricing is up. Underwriters are requesting loss runs from prior umbrella carriers, and for certain business classes, some carriers have left the market, according to the report.

D&O also saw a significant decrease in capacity of 68% in the first quarter of 2021, up slightly over the previous two quarters.

Umbrella and cyber may have seen the biggest underwriting changes, but nearly all lines were affected by current market conditions. Many respondents reported “similar, if less pronounced, increases to deductibles, reductions in limits, and shrinking capacity for the majority of lines.” A variety of tightening measures are being deployed as we see more disciplined underwriting, pressure for loss control recommendations compliance, scrutiny of loss runs, and other requirements.

Additionally, several respondents mentioned the addition of communicable disease exclusions in 1Q 2021.

CLAIMS

For the first quarter, there was a 74% increase in cyber claims, up 8% from the previous quarter. This aligns with reports of increased frequency and severity of cyber claims, which continues to drive premium rate increases.

Not far behind was employment practices, which saw an increase of 47%, up 5% from the previous quarter. “The COVID-19 pandemic has forced many organizations to make workplace changes to include remote work, office layout adjustments, staff layoffs, and/or furloughs. These changes, or failure to make these changes, were influential in increasing EPL claims,” according to CBIZ.

Business interruption claims fell to 27%, down from 38% in 4Q 2020, 62% in 3Q 2020, and a staggering 94% in 2Q 2020. These considerable decreases align with the waning of COVID-19-related infections across the country, businesses opening up, and the lack of success in court. However, it’s still double-digits above a year and a half ago when only 18% reported an increase in business interruption claims.